Overview of Logistics Managers’ Index (LMI) Movement

In February, the Logistics Managers’ Index (LMI) witnessed a significant rise, almost reaching a point higher at 56.5. This increase marks the second consecutive month of expansion across all eight subcomponents of the index. Particularly noteworthy was the trend in freight market trends, showcasing a complex pattern of growth.

Transportation Pricing and Capacity Dynamics

February continued the upward trajectory in transportation prices from previously depressed levels, as highlighted in a recent supply chain report on Tuesday. The Freight Market Trends showed a marked increase in transportation prices, with the subindex for these prices jumping to 57.6, a rise of 1.8 percentage points. However, transportation capacity’s growth rate surpassed that of pricing, suggesting a delay in a full-scale recovery in the freight market.

Variable Trends in Different Sectors

Upstream firms, including wholesalers and manufacturers, reported stronger price growth (60.9) compared to downstream entities like retailers (52.7). The overall trend in transportation pricing decelerated as February progressed, with a notable difference between the first half (62) and the latter half of the month (52.4).

Influences from External Factors

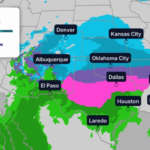

Severe winter storms earlier in the year, had temporarily constrained capacity, leading to a spike in truckload spot rates. As this backlog resolved, rates began to normalize. Other transport modes, like ocean shipping, also experienced rate fluctuations due to global events like the Red Sea conflict and drought conditions at the Panama Canal.

Future Outlook: Prices and Capacity

The LMI report’s future projections show a nuanced picture. While the immediate capacity growth outpaces price growth, indicating a delayed growth period in the freight market, the long-term outlook is more optimistic. Transportation capacity is expected to grow modestly (50.5), with a more significant rise anticipated in prices (77.1).

Detailed Insights into Other LMI Components

Inventory and Warehouse Dynamics

Inventory levels saw a significant rise, increasing by 5.7 points to 58.5. This growth, particularly stronger in upstream companies, indicates a replenishing trend post-holidays. Retailers, meanwhile, are adopting just-in-time inventory strategies, though their stock levels have also increased. Warehouse metrics remained tight, with capacity and prices growing, reflecting the upstream inventory buildup.

Overall Trends and Comparative Analysis

The overall LMI performance in February, marking its sixth expansion in seven months, suggests a robust yet cautious growth across the logistics sector. While the index is still below its all-time average, the trends in inventory costs, warehouse prices, and transportation prices combined reflect a dynamic freight market scenario.

Conclusion: Balancing Growth in the Logistics Sector

The LMI report, a collaborative effort by several universities and the Council of Supply Chain Management Professionals, paints a complex picture of the current state of the logistics and freight market. While there are signs of growth and recovery, the balance across different components and market forces indicates a cautious optimism for the future of the freight market trends.

Other Articles

Electrifying the Freight Industry: U.S. Paves the Way with Groundbreaking EV Charging Stations

In an era marked by a heightened focus on sustainability and clean energy, the United States freight trucking sector is witnessing a revolutionary transformation. The recent opening of one of the nation's largest electric vehicle (EV) charging stations for freight...

Autonomous Trucks Are Here — But Z Transportation Will Never Stop Putting Drivers First

We keep this blog honest, so here’s the unvarnished truth: driverless trucks have officially left the test-track phase. They are hauling real freight, right now, with no human in the cab. Kodiak Robotics closed Q3 2025 running 10 fully driverless trucks 24/7 in the...

Top 5 Legal Challenges Facing the Trucking Industry in 2025

The trucking industry is no stranger to legal battles, and 2025 is shaping up to be another year of shifting regulations and challenges for carriers, owner-operators, and brokers alike. As a new presidential administration settles in, changes in federal policies and state laws could have major implications for the industry. At Z Transportation, we’re keeping a close eye on the most pressing legal issues that could impact carriers, drivers, and logistics operations this year.

As an Amazon Associate, I earn from qualifying purchases. Using our links for your purchase helps us in a small way, and we earn affiliate commission without any extra expense to you.